The modern insurance industry relies less on human resources, as it can utilize specialized insurance software products. These not only reduce risks for companies but also enhance the operational potential of the business.

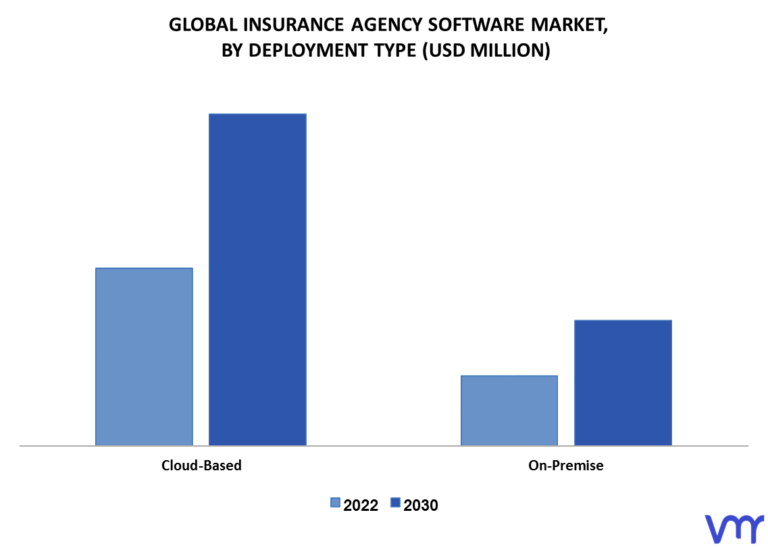

The popularity of digital solutions for the insurance segment is evident from the research by VerifiedMarketResearch. They state that the P&C insurance software segment will grow with a CAGR of 11.1% until 2030 and reach a value of $25.74 billion.

Source: VerifiedMarketResearch

From the infographic, we can see that the trend towards digitization has not bypassed even the SMB sector, which actively invests in insurance ERP and other specialized IT solutions, and for good reason.

Today, you will learn about the features of digital products for this type of business and their advantages.

In this article:

Challenges in the Insurance Industry

Despite the steady development of the segment and its peculiarities, conservative business representatives (who do not fully use an insurance software program) risk losing a portion of their profits. The problem lies in the archaic approach to process management and, as a result, a decrease in ROI.

Another challenge is a fraud, which is quite widespread and negatively impacts the insurance business by reducing companies’ trust in clients and vice versa.

Let’s explore a few key issues in the segment in more detail to determine if a specialized insurance platform can help address them.

Slow Claims Processing

The human factor is a slowing factor when it comes to processing insurance claims. Without efficient insurance IT systems, this process can take months, depending on the type and scale of the issue.

For example, in determining the compensation for the consequences of a traffic accident, many factors need to be considered, such as:

- At-fault party in the accident.

- Number of casualties.

- Nature and extent of damages.

- Drivers’ conditions at the time of the accident.

- Traffic rule violations.

- Condition of the vehicles.

- Witnesses and their testimonies.

Manual processes of collecting and verifying this and other information, including the client’s insurance history, type of policy, etc., could take a minimum of a week. With the help of a specialized insurance management solution, all these operations could be completed in a few days.

Fraud

In 2024, insurance fraud has become the norm. Per FBI analysts, fraudulent activities cost companies over $40 billion annually. This pertains solely to compensations for property, vehicles, and everything unrelated to health insurance. It’s a segment problem that can only be combated with specialized tools.

For instance, with software for insurance brokers, the latter can automate case reviews and analyze all components of insurance cases more effectively. This potentiality increases the chances of detecting fraud, minimizing losses for the insurance provider on wrongful payouts to criminals.

High Costs

The larger the insurance company, the more resources it needs for timely case processing. This includes time and the number of agents providing insurance services and handling client compensation requests.

As a result, companies incur higher expenses in maintaining staff, reducing net income, and creating various risks, such as the human factor in decision-making. Only the best commercial insurance software can help businesses minimize high losses and optimize operations, thereby increasing the company’s ROI.

Classification of Solutions for the Insurance Industry: Main Types

Depending on the business’s needs, it can utilize services from insurance software companies to build an effective IT solution. However, it is necessary to determine which type of software is needed for the company.

There is a wide variety of classifications for digital products in the insurance segment. Today, we will look at five of the most common types and determine the specific needs covered by each type.

Policy Administration Systems

IT solutions in this class are designed for managing legal and corporate provisions, including insurance terms and compensation. Independent insurance agent software and products for companies allow businesses to semi-automatically gather changes in regional legislation, economic indicators, etc., and form unique selling propositions (USPs) for clients.

Thus, users of IT solutions receive up-to-date data that helps transform their strategy and working conditions. This enables adding flexibility to the client tariffing process and personalizing services.

Claims Management Software

This type of platform belongs to the category of insurance distribution management software, as it automates the process of handling incoming requests for both policy issuance and compensation. This addresses two challenges in the insurance sector simultaneously: reducing risks and fraud and mitigating the impact of the human factor.

In addition, claims management programs increase the company’s ROI by reducing the time required for decision-making to just a few minutes (under certain conditions).

Quoting and Rating Software

Insurance brokerage software of this type is designed for risk management, such as potential losses, fraud cases, client reliability, external factors, and statistical errors.

IT solutions assist in analyzing regional circumstances and making predictions based on statistical data, investigations, etc. Based on the obtained information, service providers can personalize offers to clients, considering their credit history, external factors, and indicators of insurance cases in a specific locality.

Customer Relationship Management (CRM) Software

Agent management systems enable the insurance business to construct optimal models of interaction with clients. For example, finding new points of contact, personalizing services, and communicating.

Additionally, CRM has robust marketing potential, creating opportunities for business promotion. For instance, through aggregating and accumulating a client base, creating personalized email chains, and notifying about promotions.

Moreover, CRM optimizes communication processes, speeding up providers’ access to client information, opening direct communication channels, and partially automating the process of receiving and processing requests for policy issuance or compensation.

Underwriting Software

Underwriting IT solutions significantly expedite the processes of receiving client applications and their processing, as well as attracting a new audience. Although the industry cannot completely abandon manual operations, with the help of specialized products, it is possible to considerably accelerate these processes.

The primary purpose of systems in this class lies in automation, such as:

- Fiduciary accounting.

- Claims administration.

- Invoicing.

- 1099 management.

- Reinsurance tracking.

Also, through software testing solutions for insurance, it is possible to quickly identify issues in client data and rectify them within minutes. And this is far from the full potential of digital products for the industry.

Opportunities of IT Solutions for the Insurance Business

Today, digitization trends are displacing archaic approaches to conducting business, and the insurance segment is no exception. If a company wants to stay afloat and offer the audience a genuinely competitive solution, it needs modern digital platforms.

The potential of specialized systems is demonstrated by the capabilities they offer to insurance providers with relatively modest investments. For example, insurance technology services allow agents to spend significantly fewer resources on information collection and processing and make balanced and effective decisions.

Data Analytics

Who possesses information controls the world (the insurance market in our case). Specialized software enables providers to collect a vast amount of digital data (estimated to reach around 180 zettabytes by 2025) and process it automatically. This allows personalization of offerings, predicts market development, formulates effective strategies, and more.

Additionally, data analysis can identify fraud in compensation claims, establish trust ratings, and incorporate various external factors into the development of insurance policies.

Workflow Automation

Creating profiles, organizing policy frameworks, and formulating insurance terms consume a lot of time and resources when done manually. With modern IT solutions, a company can automate up to 99% of operations related to analytics, underwriting, and more.

Moreover, current algorithms, especially those based on AI, significantly expedite and simplify routine processes, serving as a support for decision-making. For instance, an RPA claims processing system analyzes and makes decisions in just a few minutes, relying on available facts, credit history, and form data.

Document Management

The insurance business involves numerous agreements between providers and clients, partners, banks, and investors, and significant internal document flow, often requiring iterative work on multiple document versions. All of this is associated with substantial time, paper, stationery, and office equipment resource expenditures.

Modern Electronic Document Management Systems (EDMS) centralize document work processes in a virtual environment. Thus, task delegation, signature collection, report generation, and manager approvals can all be done within minutes.

Integration Capabilities

Almost always, even the most conservative insurance companies use a range of specialized tools and systems. Developing turnkey insurance surveyor software solutions allows for tight integration of existing products with newly created ones, consolidating everything into a unified platform.

As a result, the business gets a centralized dashboard with access to all tools and the insurance agency database. This reduces the workload on agents and decreases the organization’s dependence on additional equipment (especially if the platform is implemented as SaaS and located in the cloud).

Compliance and Security

The insurance business closely interacts with clients’ data (most relevant for software for life insurance), so one of its key priorities should be information security.

Protection in modern tools is ensured through several methods, such as:

- Implementing security systems like Castle And Moat or Zero Trust.

- Adding end-to-end encryption for connections and a multi-level information access policy.

- Utilizing WEB3 technologies based on blockchain philosophy.

This is also one of the key advantages of current turnkey systems over outdated or widely accessible platforms. However, it is not the only one on our list.

Benefits of Digital Infrastructure for the Insurance Segment

Considering the opportunities that arise for insurance providers with the transition to specialized tools, such solutions offer significant advantages. We provide a brief overview of the key benefits a company receives after migrating to modern IT products.

Improved Customer Experience

The first to experience the benefits of digitization will be the clients of the insurance provider. They will fully appreciate process improvements, including service personalization, faster claims processing, and communication with company representatives.

Additionally, by using cutting-edge software suites, insurance companies can more easily adapt to market conditions and offer clients more favorable insurance terms, increased compensation, and flexible policies.

Data-Driven Decision-Making

With powerful analytics automation capabilities from various sources, businesses can make informed decisions based on accurate data and forecasts. This increases decision-making efficiency and minimizes risks, such as insurance strategy failures, applicant fraud, or failure to account for important changes in regional laws, consequently reducing the insurance provider’s financial and reputational losses.

Cost Savings

When an insurance company starts using modern tools, a large workforce, time spent on manual processes, and legal actions due to subjective decisions will become a thing of the past. Financial protection from fraudulent activities seeking undue compensation will also be improved.

Cost reduction is achieved through reduced office supplies purchases, equipment maintenance, workforce retention, and minimizing fraud.

Faster Claims Processing

Manual processing of requests, such as policy issuance, review of insurance cases, and approval of compensation, takes too much time, leading to a loss of audience loyalty or even customer attrition.

Modern IT platforms for insurance providers significantly expedite decision-making processes, enhancing the business’s reputation and increasing its competitiveness in the market.

Enhanced Efficiency

Digital products for insurance companies enable agents to perform a large number of operations simultaneously by automating a significant portion of processes. The provider’s efficiency instantly increases, leading to improved organization reviews among existing clients, stimulating audience expansion, and increasing profitability.

What's next?

Observing the development of the technological aspect of the insurance business, we can state that there is no room for conservatism and archaisms in modern business activities. Trends set the course for global digitization, and the market welcomes only those who keep up with the times and offer the audience the most advanced solutions.

Therefore, if you want to develop your insurance business successfully, now is the right time to make the correct choice and invest in the technological advancement of your brand.

Process automation, fraud risk reduction, and improved operational efficiency are all advantages of modern IT platforms that will bring you benefits in the form of increased revenue in a short period.

Don’t hesitate to order the development of a personalized corporate product now! It will help your business reach a new level.