Content

- What Is ERP?

- What Financial Management Problems ERP Solves for Your Business

- Problem #1: Inaccurate Financial Reporting

- Problem #2: Manual Data Entry Errors

- Problem #3: Lack of Visibility into Financial Performance

- Problem #4: Inefficient Financial Processes

- Problem #5: Difficulty Complying with Financial Regulations

- Problem #6: Limited Access to Financial Data

- The Best ERP FinTech Solution Tailored to Your Business Needs

For any business, a startup or a well-established enterprise, a small local company or an international organization, it is crucial to handle financial management properly.

A lot depends on how the company arranges accounting and financial management – from the ability to meet the payroll demand to maintaining healthy relationships with partners, investors, and other parties involved in the well-being of your organization.

When the company fails to track the flow of funds coming in and going out. When manual financial data processing takes ages and leads to errors. When the business does not comply with financial regulations. It means that the organization is facing serious financial management problems. And the time to act on them has come.

One of the ways to bring financial matters into order is to leverage technology. ERP, enterprise resource planning software, is a powerful solution that effectively manages different business facets, including finances.

- In this article, we are going to look at common challenges companies face when managing their finances.

- You will learn how ERP financial software simplifies financial management and helps organizations succeed.

Let’s dive in!

What Is ERP?

Simply put, an ERP is an integrated software allowing to manage corporate data across the entire organization. ERP systems are packaged business systems integrating major business processes. These solutions usually cover, but are not limited to:

- Accounting and financial management

- Human resources

- Asset management

- Manufacturing

- Supply chain management

- Back-office functions

Most importantly, ERP software can be seamlessly integrated with other modules like CRM, warehouse management, inventory management, manufacturing and planning, and other apps through a finance API. This will ensure faster communication between the departments, eliminate the need for duplicate data entry, and streamline business operations.

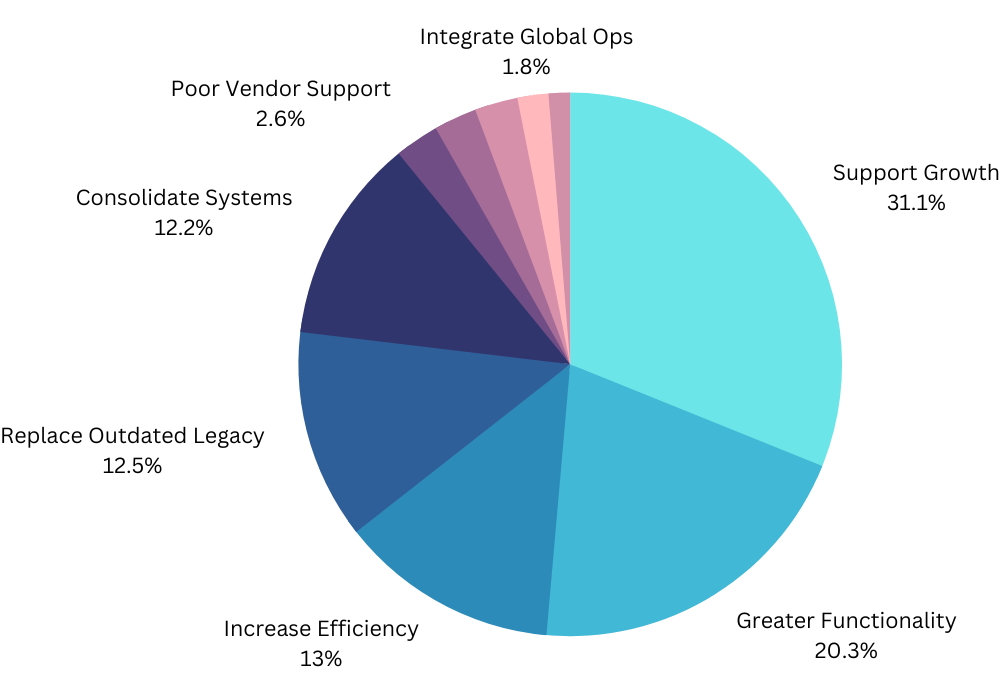

Below are the top reasons to implement an ERP for companies focused on growth, better performance, and improved efficiency.

What Financial Management Problems ERP Solves for Your Business

ERP is far more efficient for managing finances than any other standalone fintech software. Actually, since it integrates different modules and allows handling a wide range of operations from a centralized hub, employees avoid digital fatigue and maintain their concentration, skipping the need to switch between several applications.

From the standpoint of business value, nearly 89% of organizations claim that they have implemented ERP for its ability to manage finances and run accounting operations. This begs the conclusion that ERP is highly effective for tackling day-to-day financial management challenges. And if so many companies entrust their finances to this particular software type, then there is definitely something to it.

So, what hot issues can your company solve with ERP solutions? Let’s check it out below.

Problem #1: Inaccurate Financial Reporting

Finance teams spend 48% of their time creating and updating reports. And it’s nearly half of the working time. As financial departments are so bogged down in putting together financial details, they have no time left to uncover valuable insights from data. Insights can be game-changing for defining the future course of actions for the company.

A financial report can show where your company is underperforming and misses opportunities. With financial statements, you can get insights into how much money you have made in sales and what expenses are coming up next quarter. Additionally, reports are essential for banks, tax authorities, shareholders, and other parties.

Thus, a modern approach to financial reporting is required. The one that allows faster financial reporting – like the use of ERP.

- ERP has a powerful finance module for efficient financial reporting that allows companies to make smarter decisions and comply with regulations.

- ERP software streamlines all the steps of financial reporting and offers a comprehensive solution for timely and meaningful data transformation into actionable insights.

- The reports generated with ERP are highly customizable, so your company will easily meet the specific requirements of various agencies – with a few clicks.

Problem #2: Manual Data Entry Errors

Data entry errors are common when the human factor is in the game. To err is human, and we all are bound to make mistakes. The research carried out by Raymond R. Panko uncovers striking findings. The probability of a human error varies between 18% and 40% when manually entering data into simple spreadsheets. In complex spreadsheets, the likelihood of errors is even higher.

For a business, the cost of a misplaced or wrong decimal can be dramatic. Anything can happen, from spending a huge amount of time and money correcting a single mistake to ruining the reputation entirely. When decision-makers consider wrong data, they may easily take the wrong direction.

That’s why companies use ERP finance solutions to improve data quality.

- A well-programmed software is very unlikely to enter wrong data or make other mistakes.

- It works consistently, without any fatigue, doing all the calculations or formatting the file automatically, leaving no space for incorrect data.

Problem #3: Lack of Visibility into Financial Performance

These days, businesses are forced to make decisions faster than ever. But making strategic decisions without a full picture of the financial position is like fighting against the wind. Paper spreadsheets or poorly organized financial documentation hinder the decision-making process. Thus, cutting the route that allows seizing upon new opportunities. Quickly and with minimal risks.

Without a clear vision of the financial performance of the organization, top managers won’t be able to set a budget or assign financial resources for different purposes like employee training, salaries, procurement, asset maintenance, marketing campaigns, and more.

So, the ERP financial software will consolidate all the critical information in one place, making it instantly accessible to everyone.

- It helps understand what is happening with corporate finances on the operational decision-making level.

- Some ERPs feature a forecasting module that considers current data and takes other variables into account to project the outcomes of this or that decision.

Problem #4: Inefficient Financial Processes

If you are still entering all financial data manually. Or even worse – jotting down everything with pen and paper. You may be surprised to reveal what expenses that involved. Not to be unfounded, here are some figures for you.

Micro businesses spend nearly a third (31%) of their time on financial admin work, while small companies devote 25% of their working time to manually handling financial administrative work.

Another report suggests that seven in ten finance teams (roughly 70%) spend up to 520 hours per year on AP duties. Another 28% of respondents say that their teams dedicate up to 1,040 hours annually (20 hours a week) to AP tasks that could be automated. That is, be performed by fintech software. It encompasses invoice and payment processing, PO matching, new supplier registration, and more.

With ERP, the vast majority of financial processes can be automated.

- This financial technology will streamline invoice generation, limit approvals, bank reconciliations, and other operations – so the finance teams do not have to do the job manually.

- It also simplifies cash management and financial statement generation.

- The ERP makes it simple to collect and store data across different departments eliminating data duplications and ensuring easy access to essential information.

Problem #5: Difficulty Complying with Financial Regulations

Compliance with financial regulations is a major concern for many businesses. Failing to meet regulations costs organizations billions. On average, businesses lose $5.87 million in revenue because of a single non-compliance event. But this is just the tip of the iceberg.

Apart from affecting the organization’s bottom line, these events also involve the loss of productivity, business disruption, fines and penalties, reputation damage, and more. To sum it up, the total cost of non-compliance can reach $14 million.

If your organization is not ready for these expenses, ERP will help tackle this financial management issue.

- With the ERP at hand, your staff will make sure the company abides by all the rules and regulations in the industry.

- It will provide your organization with tracking capabilities so you never find yourself in a bad situation when IRS is looking over your shoulder to find discrepancies in numbers.

Problem #6: Limited Access to Financial Data

While some employees on the company level can have limited access to certain data because of legal or role-specific reasons, the issue of poor data sharing is not always tied to these objectives. In most cases, information is not organized in a presentable and useful way (46%) or employees do not know what repository to use (33%).

Hence, the collaboration between departments suffers. And decision-makers of different levels may be blind when making business-critical decisions. Additionally, companies that rely on paper-based documentation make critical data unavailable to employees working from home or on-site rather than in the office.

With a robust ERP system, your company can let employees harness the power of data, no matter what device they use and where they are physically.

- When using ERP solutions, companies can grant and control access to critical data to authorized users – making it available for employees in seconds.

- ERP makes data accessible in seconds from anywhere – as all the information is standardized and stored in a digital format in one place.

- With ERP, even big chunks of data can be processed fast, providing you with the relevant information in mere seconds.

The Best ERP FinTech Solution Tailored to Your Business Needs

ERP offers a host of benefits for financial management. But not all ERP systems are the same. In some cases, off-the-rack finance solutions do not give the desired functionality or required flexibility. That’s when custom ERP development comes to the rescue.

At ADVANTISS, you will get a full range of services when you decide to get more clarity in payment processing, automate financial management, and achieve a new level of data accuracy, accessibility, and compliance. From consulting regarding what solution will meet your needs best to building ERP from scratch and maintaining it, we have you covered.

Contact us to discuss how the ADVANTISS team will deliver the ERP solution catered to your company’s financial management needs.