Our team collaborated with the client’s company through an outsourcing model, actively involving their employees and stakeholders throughout the project to ensure that the outcome met all requirements.

Insurance ERP: Policy Tracking, Compliance, and Client Management

Client

12 months (MVP)

SERVICES WE PROVIDED

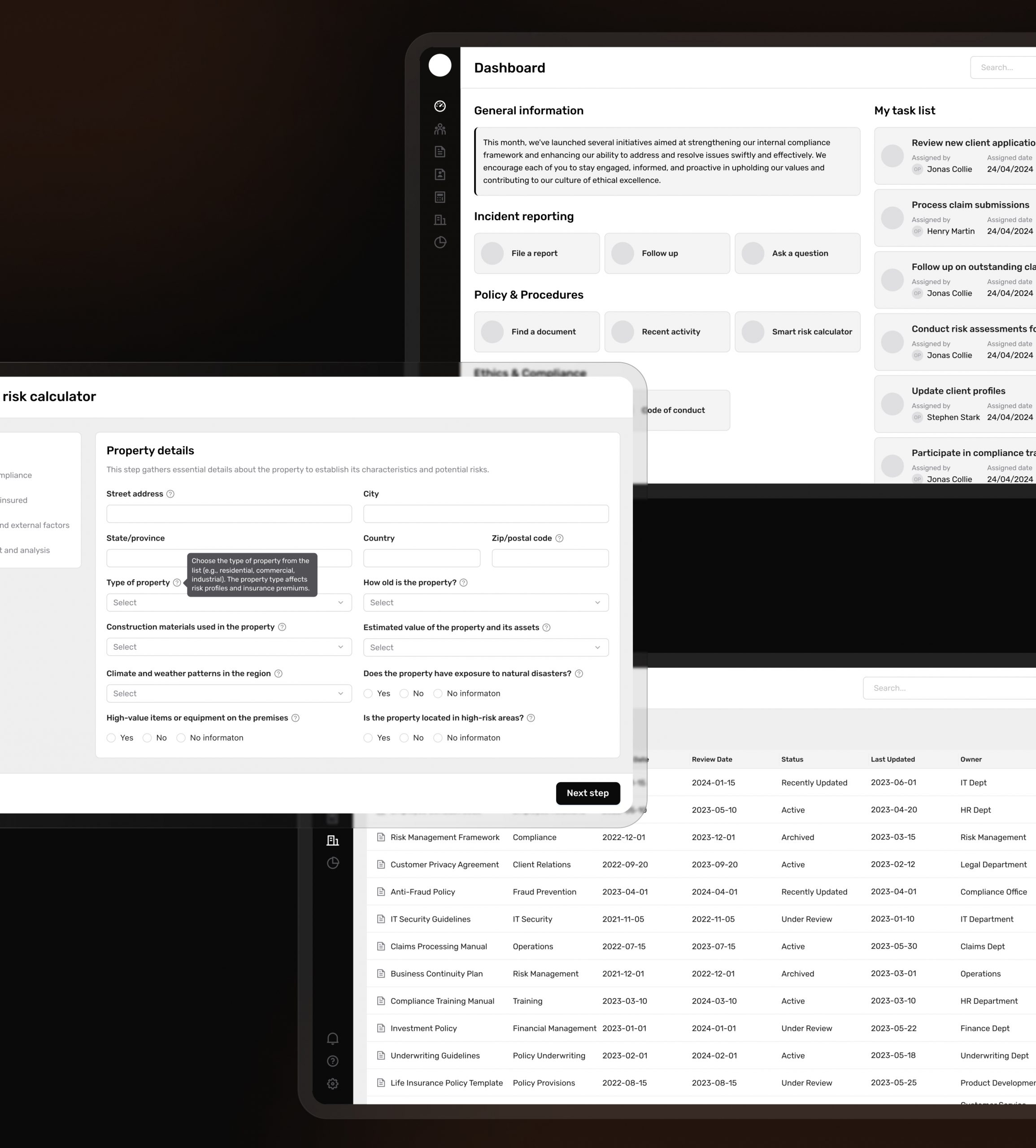

Risk Assessment and Management: Ensuring accurate risk assessment and management across various insurance products.

Client Information Management: The lack of a centralized system for managing client information led to inefficiencies in communication and service delivery.

Policy Tracking: Tracking policies across different stages helps reduce the risk of regulatory breaches, financial penalties, and reputational damage.

Compliance Adherence: Navigating complex regulatory requirements, including licensing, capital requirements, and product approval.

Data Privacy and Security: Ensuring data privacy and security in compliance with regulatory standards like eSign.

Integration with Other Systems: Seamless integration with IP telephony, payment, and accounting systems was necessary for operational efficiency.

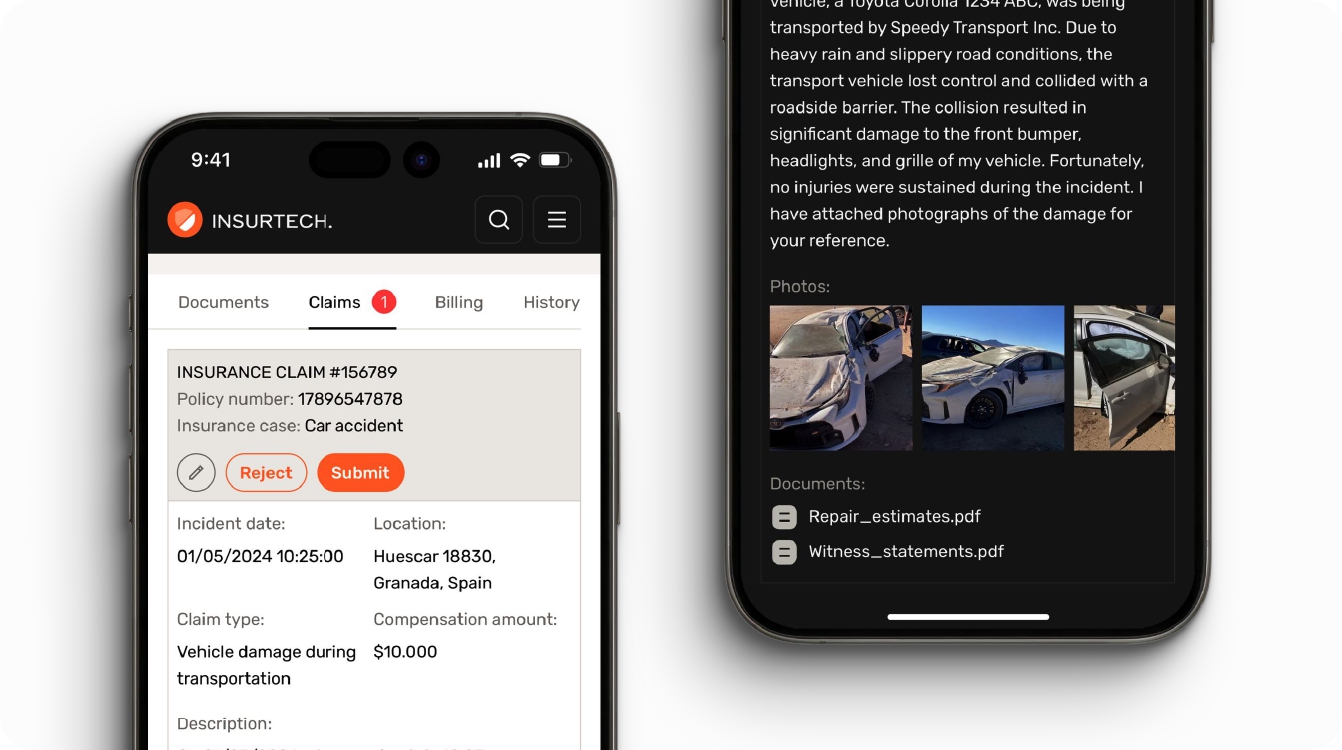

Report Policy Violations: Ability to report suspected policy violations within the system for investigation.

Automation: Automated workflows to improve efficiency.

Centralized Data Management: A centralized platform for managing client information and policy data.

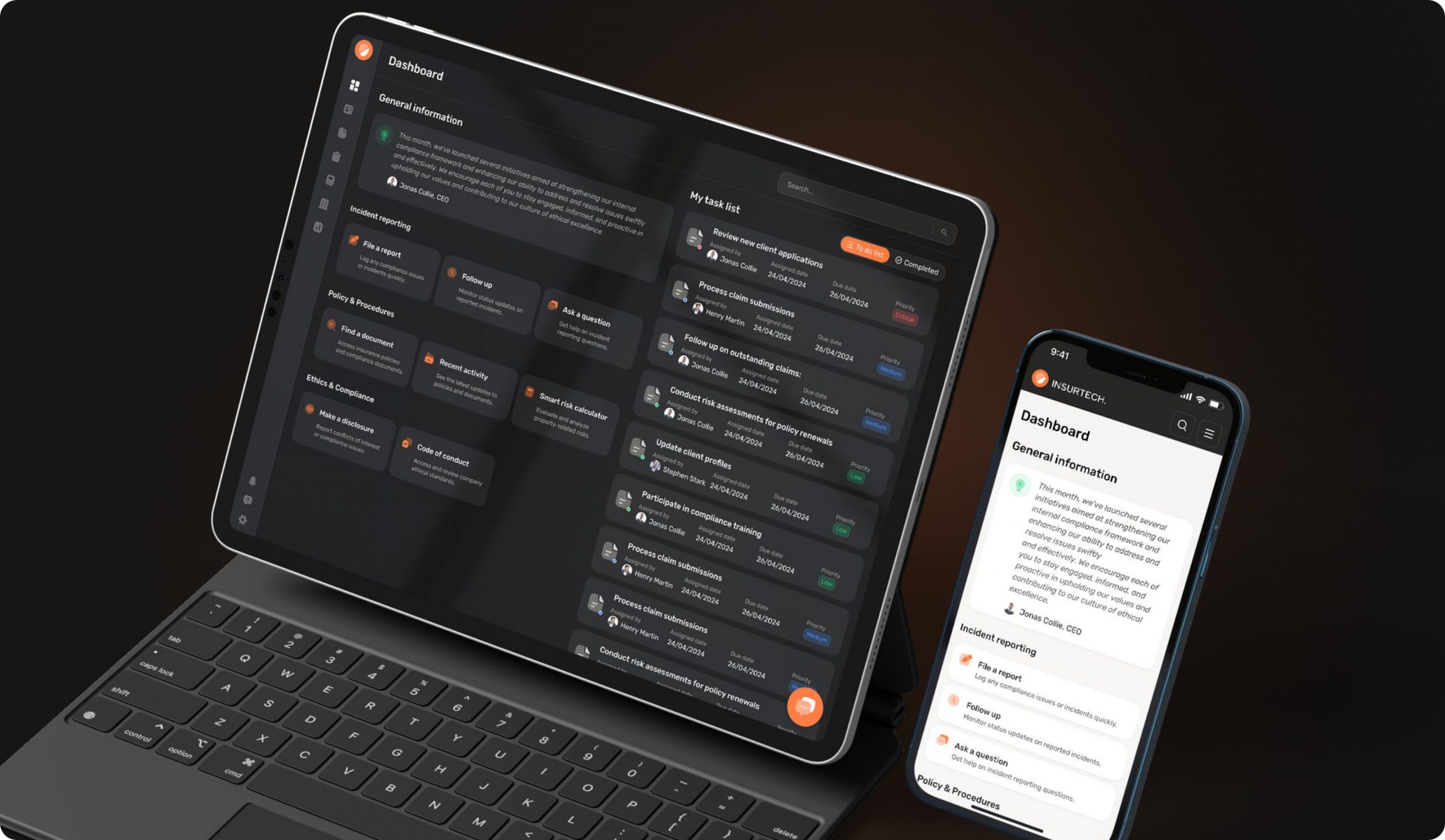

B2C and B2B Access: Two types of access tailored for both individual and business-facing departments.

Monitoring and Alerts: Monitoring and alerts for compliance and risk management.

Conflict of Interest Detection: Conflict of interest detection and monitoring to reduce regulatory risks.

Reporting and Disclosure: Automates reporting capabilities for management information and regulatory disclosure.

Web and Mobile App: The customer app should display the terms of the current insurance policy and provide clients with a convenient way to submit an insurance claim.

COOPERATION

CORE FEATURES WE IMPLEMENTED

TEAM COMPOSITION

RESULTS WE ACHIEVED

Automated Workflows

Automated workflows and centralized data management reduced manual efforts by 40%

Regulatory Adherence

Compliance features ensured regulatory adherence, resulting in a 28% reduction in compliance-related incidents and penalties

Client Engagement

Web and mobile applications increased client engagement by 60%, providing convenient access to policy information and claim submission

Data Leak Prevention

Two-factor authentication and data leak prevention measures bolstered data security, reducing the risk of data breaches